Discover the Best Payroll App for Android: Simplify and Streamline Your Payroll Process

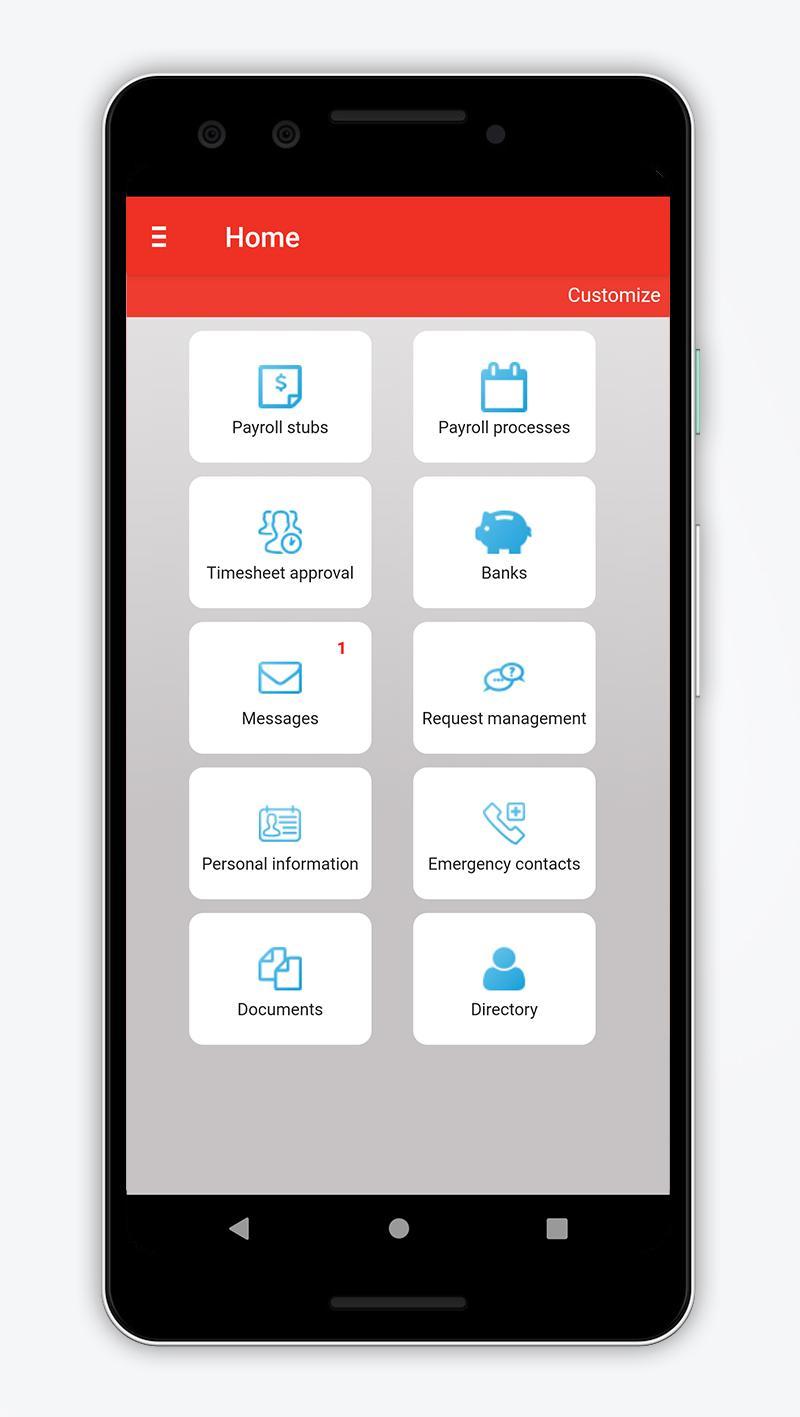

Are you tired of spending endless hours manually calculating employee wages, deductions, and tax withholdings? Look no further than the payroll app for Android. With its user-friendly interface and powerful features, this app is designed to simplify and streamline your payroll process, leaving you with more time to focus on other important aspects of your business.

In this comprehensive guide, we will dive deep into the world of payroll apps for Android. We will explore the key features that make these apps indispensable tools for businesses of all sizes and industries. Whether you are a small business owner or a payroll manager in a large enterprise, this article will provide you with the essential information you need to make an informed decision when choosing the right payroll app for your Android device.

Introduction to Payroll Apps for Android

Managing payroll can be a complex and time-consuming task for businesses. Traditionally, payroll processes involved manual calculations, extensive paperwork, and a high risk of human error. However, with the advent of technology, payroll apps for Android have emerged as game-changers in the world of payroll management. These apps offer a range of features and functionalities that automate and streamline the entire payroll process.

By leveraging the power of mobile technology, payroll apps for Android allow businesses to handle their payroll tasks efficiently on the go. These apps enable you to easily calculate employee wages, handle tax withholdings, generate pay stubs, and even facilitate direct deposits, all from the convenience of your Android device. With their user-friendly interfaces and intuitive designs, these apps make it possible for even non-experts to navigate the complexities of payroll management with ease.

Benefits of Automating Payroll

The automation of payroll tasks through Android apps brings several benefits to businesses. Firstly, it significantly reduces the time and effort required to process payroll. Manual calculations and paperwork are replaced with automated systems, enabling businesses to complete payroll processes in a fraction of the time. This time-saving feature allows business owners and payroll managers to allocate their resources more efficiently and focus on other critical aspects of their operations.

Secondly, utilizing a payroll app for Android ensures greater accuracy in payroll calculations. Manual calculations are prone to errors, which can lead to costly mistakes and disgruntled employees. Payroll apps eliminate these risks by automating calculations and adhering to tax regulations, ensuring accurate and error-free payroll processing. This accuracy not only saves businesses from financial and legal consequences but also boosts employee satisfaction and trust in the payroll system.

Lastly, payroll apps for Android provide businesses with enhanced accessibility and flexibility. With these apps, businesses can process payroll from anywhere, at any time. Whether you're on a business trip, working remotely, or simply away from your office, you can conveniently manage your payroll tasks using your Android device. This flexibility not only improves the efficiency of payroll processing but also ensures that businesses can meet their payroll obligations promptly, regardless of their location.

Key Features of Payroll Apps

Payroll apps for Android come equipped with an array of features that make them invaluable tools for businesses. Understanding these key features will help you evaluate and choose the right payroll app that aligns with your specific business needs. Let's explore some of the essential features:

Employee Time Tracking

Accurately tracking employee working hours is a crucial component of payroll management. Payroll apps for Android often include built-in time tracking features that allow employees to clock in and out, record breaks, and track overtime. These time logs can be seamlessly integrated with the payroll system, ensuring accurate wage calculations and saving businesses the hassle of manually tracking employee hours.

Tax Calculations and Compliance

Calculating taxes can be a daunting task for businesses, with ever-changing tax laws and regulations. Payroll apps for Android simplify this process by automatically calculating federal, state, and local taxes based on employee profiles and location. These apps ensure compliance with tax regulations and generate accurate tax reports, reducing the risk of costly errors and penalties.

Direct Deposit

Payroll apps often offer the convenience of direct deposit, allowing businesses to deposit employees' wages directly into their bank accounts. This eliminates the need for paper checks and manual distribution, saving time and resources. Additionally, direct deposit ensures prompt payment and eliminates the risk of lost or stolen paychecks.

Reporting and Analytics

Comprehensive reporting and analytics functionalities are essential for businesses to gain insights into their payroll data. Payroll apps for Android typically provide customizable reports that offer a detailed breakdown of payroll expenses, tax liabilities, and employee earnings. These reports enable businesses to analyze payroll trends, identify areas for cost savings, and make informed financial decisions.

Employee Self-Service

Employee self-service features empower employees to access their payroll information and manage personal details independently. Through the payroll app, employees can view their pay stubs, tax forms, and year-to-date earnings, reducing the need for HR personnel to handle individual inquiries. This feature not only saves time but also promotes transparency and empowers employees to take ownership of their payroll-related matters.

Finding the Right Payroll App for Your Business

Choosing the right payroll app for your business is crucial to ensure smooth and efficient payroll management. With the plethora of options available in the market, it's essential to consider certain factors before making a decision. Here are some key factors to consider when finding the perfect payroll app for your Android device:

Scalability

Consider the scalability of the payroll app. Will it be able to accommodate your business's growing needs? Ensure that the app can handle an increasing number of employees, adapt to changing tax regulations, and integrate with other systems as your business expands.

Integration Capabilities

Check whether the payroll app can integrate seamlessly with your existing HR or accounting software. Integration capabilities eliminate the need for manual data transfer between systems, ensuring data accuracy and reducing administrative burdens.

Customer Support

Reliable customer support is crucial when dealing with any software or application. Look for a payroll app provider that offers responsive customer support, readily available documentation, and frequent updates to address any issues or concerns that may arise.

User-Friendly Interface

A user-friendly interface is essential for ensuring that employees and payroll managers can navigate the app with ease. Look for apps with intuitive designs, clear instructions, and minimal learning curves to maximize user adoption and minimize training requirements.

Security and Data Privacy

Payroll data contains sensitive and confidential information. Prioritize apps that prioritize security and data privacy. Look for features such as data encryption, secure servers, and compliance with industry-standard security protocols to ensure that your payroll information remains protected.

The Benefits of Using a Payroll App for Android

The benefits of using a payroll app for Android extend beyond simplifying and streamlining the payroll process. Let's delve into some of the key advantages that these apps bring to businesses:

Time and Cost Savings

Automating payroll processes through Android apps saves businesses significant amounts of time and money. The reduced time spent on manual calculations and paperwork allows business owners and payroll managers to allocate their resources more efficiently. Additionally, the elimination of manual errors and the need for physical checks reduces costs associated with correcting mistakes and printing paper checks.

Accuracy and Compliance

Payroll apps for Android ensure accurate calculations, reducing the risk of human error. These apps automatically calculate wages, deductions, and taxes based on the latest regulations, ensuring compliance and minimizing the risk of penalties. By automating complex calculations, businesses can have peace of mind knowing that their payroll processes are accurate, up to date, and compliant.

Efficiency and Productivity

Streamlining payroll processes through mobile apps improves overall efficiency and productivity. With simplified workflows, businesses can process payroll more quickly, allowing employees to receive their wages promptly. This efficiency not only saves time but also boosts employee morale and satisfaction, contributing to a positive work environment.

Data Accessibility and Insights

Payroll apps provide businesses with easy access to comprehensive payroll data and insights. Through customizable reports and analytics features, businesses can gain valuable insights into their payroll expenses, identify trends, and make data-driven decisions. These insights can help businesses optimize their payroll processes, identify cost-saving opportunities, and improve overall financial management.

Setting Up Your Payroll App

Once you have selected the right payroll app for your Android device, it's time to set it up and configure it according to your business requirements. While the setup process may vary depending on the app you choose, here is a general guide to get you started:

Step 1: Account Creation

Begin by creating an account with the payroll app provider. Provide the necessary information, such as your business name, address, and contact details. Some apps may require additional verification steps to ensure the security of your account.

Step 2: Employee Setup

Add your employees' information to the payroll app. This includes their names, contact information, tax withholding details, and any other relevant information required for accurate payroll calculations. Some apps may offer bulk import options or integration with other HR systems for seamless employee data transfer.

Step 3: Payroll Configuration

Configure your payroll settings according to yourbusiness requirements. This includes setting up pay periods, wage rates, overtime rules, and any other relevant payroll parameters. Take the time to review and double-check these settings to ensure accurate calculations and compliance with labor laws and regulations.

Step 4: Tax Settings

Configure your tax settings based on your business location and the tax regulations applicable to your employees. Provide the necessary information, such as tax identification numbers and tax rates. Many payroll apps offer built-in tax calculators that automatically calculate taxes based on employee profiles and current tax laws.

Step 5: Payment Methods

Set up your preferred payment methods for employee wages. This may include options such as direct deposit, paper checks, or payment through third-party payment processors. Ensure that the payment methods you choose align with your employees' preferences and your business's banking capabilities.

Step 6: Test and Review

Before fully implementing your payroll app, it's essential to test and review the setup to ensure accuracy and functionality. Run test payrolls to verify that the app calculates wages, deductions, and taxes correctly. Review the generated reports and pay stubs to ensure all information is accurate and aligns with your expectations.

Step 7: Employee Onboarding

Once you have set up and tested your payroll app, it's time to onboard your employees. Provide them with instructions on how to access their payroll information, including pay stubs, tax forms, and any other relevant details. Offer training or resources to help employees navigate the app and answer any questions they may have.

Managing Employee Information

Effective management of employee information is crucial for accurate payroll processing. Payroll apps for Android offer various features that facilitate efficient employee data management. Let's explore some essential aspects:

Adding and Updating Employee Profiles

Payroll apps allow you to easily add new employees to the system. Provide their basic information, such as name, contact details, and employment start date. Additionally, these apps enable you to update existing employee profiles with any changes, such as address, marital status, or tax withholding adjustments.

Tracking Vacation and Sick Leave

Many payroll apps provide features to track and manage employee vacation and sick leave. You can set up accrual rules and automatically calculate available leave balances based on your business's policies. Employees can request time off through the app, and managers can review and approve these requests, ensuring accurate leave tracking and seamless integration with payroll calculations.

Timesheets and Time Tracking

Payroll apps often include timesheet features that allow employees to submit their work hours and managers to review and approve them. These timesheets can be integrated with payroll calculations, ensuring accurate wage calculations and reducing the need for manual data entry. Time tracking features also help monitor employee attendance and track overtime hours.

Document Storage and Access

Payroll apps provide a secure and centralized platform for storing employee documents. This includes pay stubs, tax forms, employment contracts, and other relevant paperwork. These documents can be easily accessed by employees, managers, and HR personnel, eliminating the need for physical filing systems and reducing administrative burdens.

Employee Self-Service Portal

Employee self-service portals empower employees to access and manage their payroll information independently. Through these portals, employees can view their pay stubs, update personal details, submit time-off requests, and access important tax documents. This feature enhances transparency and empowers employees to take ownership of their payroll-related matters.

Processing Payroll

Processing payroll accurately and efficiently is the core function of a payroll app. Let's explore the steps involved in processing payroll using your Android payroll app:

Step 1: Review Timesheets and Attendance

Begin by reviewing employee timesheets and attendance records. Ensure that all hours worked, including regular hours, overtime, and any other applicable pay rates, are accurately recorded. Check for any discrepancies, missing entries, or exceptions that may require attention.

Step 2: Calculate Gross Wages

Using the data from timesheets and employee profiles, the payroll app will automatically calculate gross wages. This includes regular hours, overtime hours, and any applicable bonuses or commissions. The app should apply the correct pay rates and calculate any adjustments based on your business's policies.

Step 3: Deductions and Withholdings

The payroll app will deduct various withholdings from employees' gross wages. This includes federal, state, and local taxes, as well as other deductions such as healthcare premiums, retirement contributions, and garnishments. The app should automatically calculate these deductions based on employee profiles and the latest tax laws.

Step 4: Net Pay Calculation

After deducting all applicable withholdings, the payroll app will calculate the net pay for each employee. This is the amount that employees will receive in their bank accounts or through other payment methods selected during the app setup. The app should provide a clear breakdown of the net pay, including all deductions and the final amount.

Step 5: Generate Pay Stubs and Reports

The payroll app will generate pay stubs for each employee, detailing their earnings, deductions, and net pay. These pay stubs should be easily accessible to employees through the self-service portal or email. Additionally, the app should provide various reports, such as payroll summaries, tax liability reports, and wage expense reports, to help businesses analyze their payroll data and meet reporting requirements.

Step 6: Direct Deposit or Payment Distribution

If you have set up direct deposit as the payment method, the payroll app will facilitate the electronic transfer of funds to employees' bank accounts. For other payment methods, such as paper checks or third-party payment processors, the app should provide instructions and options for generating and distributing these payments accurately and efficiently.

Tax Compliance and Reporting

Ensuring tax compliance is a critical aspect of payroll management. Payroll apps for Android offer features that help businesses meet their tax obligations. Let's explore some key functionalities:

Automated Tax Calculations

Payroll apps automatically calculate federal, state, and local taxes based on employee profiles and the latest tax laws. These apps stay up to date with changes in tax rates and regulations, ensuring accurate tax calculations. By automating tax calculations, businesses can minimize errors and ensure compliance with tax laws.

Tax Form Generation

Payroll apps generate tax forms, such as W-2s and 1099s, for employees and contractors. These forms are crucial for employees' tax filings and reporting income to the tax authorities. The app should generate these forms accurately and in compliance with the formatting requirements set by the tax authorities.

Quarterly and Year-End Tax Reporting

Payroll apps provide features to generate comprehensive reports for quarterly and year-end tax filings. These reports summarize payroll expenses, tax liabilities, and employee earnings for the respective periods. The app should generate these reports in the required formats, making it easier for businesses to meet their tax reporting obligations.

Tax Filing Reminders

Many payroll apps offer reminders and notifications to ensure businesses stay on top of their tax filing deadlines. These reminders help businesses avoid penalties and late fees by providing timely notifications of important tax-related dates.

Security and Data Privacy

Given the sensitive nature of payroll data, security and data privacy are paramount when choosing a payroll app for Android. Let's explore the security measures and data privacy features that the best payroll apps offer:

Data Encryption

Payroll apps should employ robust encryption protocols to protect data during transmission and storage. This ensures that employee information, wage details, and other sensitive payroll data remain confidential and secure.

Secure Servers and Backups

The payroll app's servers should be secure, protected by firewalls and other security measures to prevent unauthorized access. Regular data backups should be performed to ensure that data can be restored in case of any unforeseen events or system failures.

User Access Controls

Payroll apps should offer granular user access controls, allowing businesses to define roles and permissions for each user. This ensures that only authorized personnel can access sensitive payroll data and perform specific actions within the app.

Compliance with Privacy Regulations

Payroll apps should comply with relevant privacy regulations, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA). These regulations aim to protect individuals' personal information and require businesses to handle data responsibly and transparently.

Troubleshooting and Support

While payroll apps for Android are designed to be user-friendly, occasional issues or questions may arise. It's important to have access to reliable support to address these concerns. Here are some troubleshooting tips and support options:

Knowledge Base and Documentation

Payroll app providers often maintain a knowledge base or documentation that offers detailed instructions, tutorials, and troubleshooting guides. These resources can be valuable references when you encounter any issues or need clarification on specific features.

Customer Support Channels

Reach out to the payroll app provider's customer support team when you need assistance. Reliable providers offer various support channels such as email, livechat, or phone support. Explain your issue or question clearly, providing any relevant information or screenshots to help the support team understand and address your concern effectively.

Online Community and User Forums

Check if the payroll app has an online community or user forums where you can interact with other users and seek advice or solutions to common issues. These platforms can be valuable resources for troubleshooting and learning from others' experiences.

Software Updates

Regularly check for software updates provided by the payroll app provider. Updates often include bug fixes, feature enhancements, and improved security measures. Keeping your app up to date ensures optimal performance and minimizes the risk of encountering issues.

Training and Onboarding Assistance

If you are new to using a payroll app or require additional training, inquire with the app provider about available training resources or onboarding assistance. Some providers offer webinars, video tutorials, or personalized training sessions to help users get the most out of their payroll app.

Third-Party Consultants or Accountants

If you encounter complex payroll issues or require expert advice, consider consulting with third-party payroll consultants or accountants. These professionals specialize in payroll management and can provide guidance tailored to your specific business needs.

Conclusion

Choosing the right payroll app for your Android device is a crucial decision that can significantly simplify and streamline your payroll management processes. By leveraging the power of technology, these apps automate calculations, ensure accuracy, and provide valuable reporting and analytics features.

In this comprehensive guide, we have explored the world of payroll apps for Android, delving into their key features, benefits, and the considerations to keep in mind when selecting the right app for your business. We have discussed the importance of automating payroll processes, the advantages of using mobile apps for payroll management, and the various functionalities offered by these apps.

We have also provided detailed insights into setting up your payroll app, managing employee information, processing payroll, ensuring tax compliance, maintaining security and data privacy, and troubleshooting any issues that may arise. By following the steps and best practices outlined in this guide, you can effectively implement and optimize your Android payroll app to simplify your payroll management and enhance your overall business operations.

Embrace the power of technology and take your payroll management to the next level with the best payroll app for Android. Say goodbye to tedious manual calculations and welcome a more efficient and streamlined approach to payroll processing. Invest in the right payroll app today and unlock the potential for time and cost savings, accuracy and compliance, enhanced productivity, and improved employee satisfaction.

Post a Comment for "Discover the Best Payroll App for Android: Simplify and Streamline Your Payroll Process"